INTRODUCTION

This material is applicable for SAP ECC 5 and ECC 6 version.

SAP has introduced a new concept called as SAP New GL structure. Let us understand this concept of SAP New GL structure and its use.

Typically in SAP you can depict parallel accounting, which means you can carry out valuations and closing operations for a company code according to local accounting principle and a second accounting principle (parallel) i.e. the group accounting principle.

Until version 4.7 you could carry out the parallel accounting only by using additional accounts.

Certain GL accounts are common between 2 the accounting areas. Certain GL accounts applicable only for local reporting

Certain GL accounts applicable only for group reporting. This kind of a set up requires 2 retained earnings accounts.

The disadvantage of this set ups is lot of GL accounts are required and sometimes reconciliations become difficult.

To do away with the above approach SAP has now introduced the SAP New GL structure. In this approach parallel accounting is depicted using an additional ledger.

The data for one accounting principle is stored in the general ledger. This ledger is known as the Leading ledger or Leading valuation view.

For each additional (parallel) accounting principle, you create an additional ledger

The advantages of this approach are:-

Company code 9101 is created in SAP

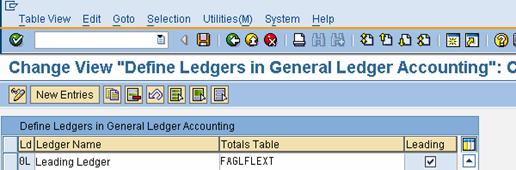

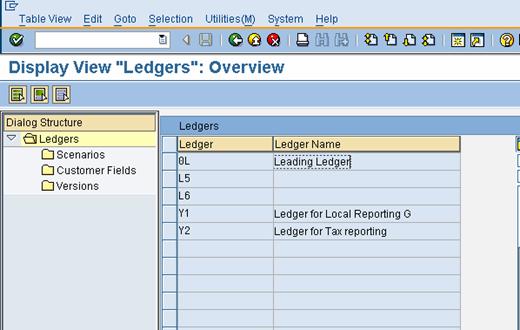

2. Ledgers (New)

2.1.1 Ledger

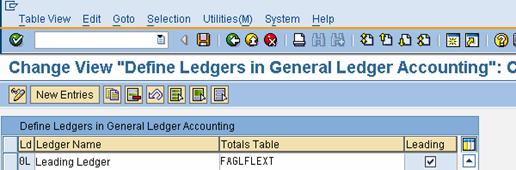

2.1.1.1 Define Ledgers for General Ledger Accounting

You define the ledgers that you use in General Ledger Accounting. The ledgers are based on a totals table. SAP recommends using the delivered standard totals table FAGLFLEXT.

The following types of ledgers are available:

Leading Ledger

Click

Now update the following:-

Click on

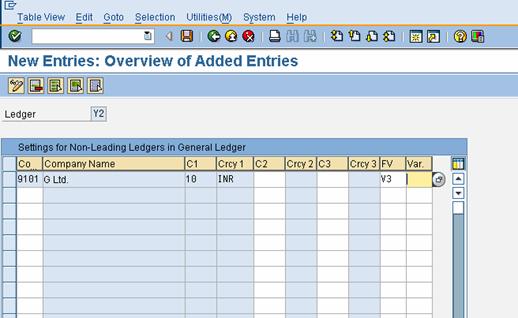

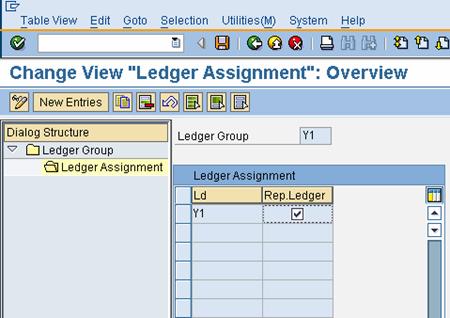

2.1.1.3 Define and Activate Non-Leading Ledgers

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Define and Activate Non-Leading Ledgers

Here you make the following settings for the non -leading ledgers for each company code:

You activate the non-leading ledgers in the company code.

This material is applicable for SAP ECC 5 and ECC 6 version.

SAP has introduced a new concept called as SAP New GL structure. Let us understand this concept of SAP New GL structure and its use.

Typically in SAP you can depict parallel accounting, which means you can carry out valuations and closing operations for a company code according to local accounting principle and a second accounting principle (parallel) i.e. the group accounting principle.

Until version 4.7 you could carry out the parallel accounting only by using additional accounts.

Certain GL accounts are common between 2 the accounting areas. Certain GL accounts applicable only for local reporting

Certain GL accounts applicable only for group reporting. This kind of a set up requires 2 retained earnings accounts.

The disadvantage of this set ups is lot of GL accounts are required and sometimes reconciliations become difficult.

To do away with the above approach SAP has now introduced the SAP New GL structure. In this approach parallel accounting is depicted using an additional ledger.

The data for one accounting principle is stored in the general ledger. This ledger is known as the Leading ledger or Leading valuation view.

For each additional (parallel) accounting principle, you create an additional ledger

The advantages of this approach are:-

- You do not have to create any additional G/L accounts

- You manage a separate ledger for each accounting principle

- You can use the standard reporting functions to create a financial statement

- You can have different fiscal year variants attached to each of the additional ledger.

- You can make manual postings to any of the additional ledgers.

Configuration Scenario:

A Grp of companies (Parent company) is a multinational company with companies across the world with base in Germany. The company has decid ed to implement SAP for its subsidiary G Ltd located in India. A Grp of companies have to use the common chart of accounts. The currency in India is INR. The Parent company wants the accounts to be prepared based on Calendar year January to December. The Financial reporting should be in EURO.

G Ltd has a local reporting requirement under the companies act

G Ltd also has a tax requirement to prepare it Accounts based on accounting period April to March.

A Grp of companies (Parent company) is a multinational company with companies across the world with base in Germany. The company has decid ed to implement SAP for its subsidiary G Ltd located in India. A Grp of companies have to use the common chart of accounts. The currency in India is INR. The Parent company wants the accounts to be prepared based on Calendar year January to December. The Financial reporting should be in EURO.

G Ltd has a local reporting requirement under the companies act

G Ltd also has a tax requirement to prepare it Accounts based on accounting period April to March.

Based on the above requirements we need to configure the following using the SAP New GL Structure

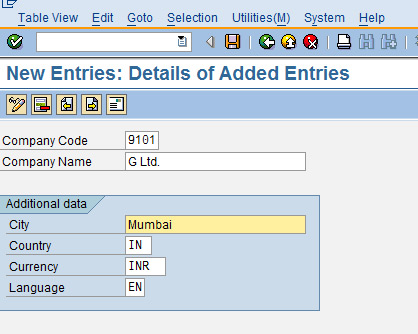

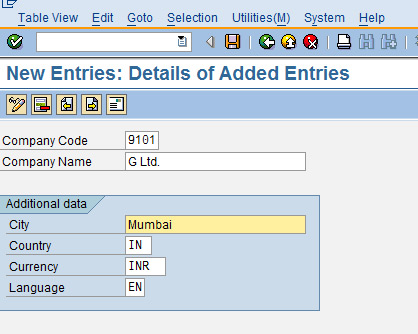

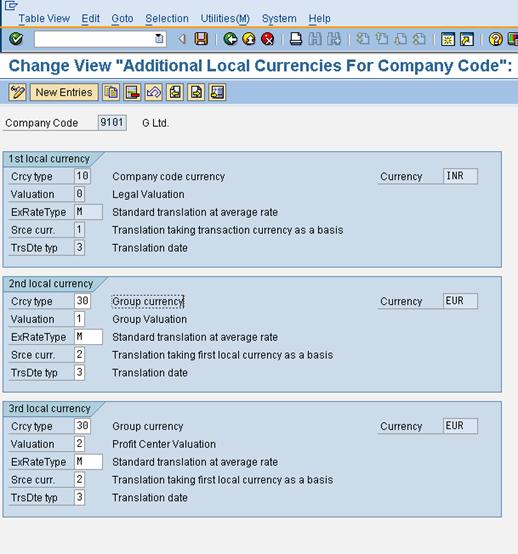

Create company code 9101 – G Ltd. The company code currency– INR

Parallel currencies to be implemented – EURO

Common chart of accounts – YCCA

Ledger 0L (leading valuation view) reporting period – Jan to December for group reporting

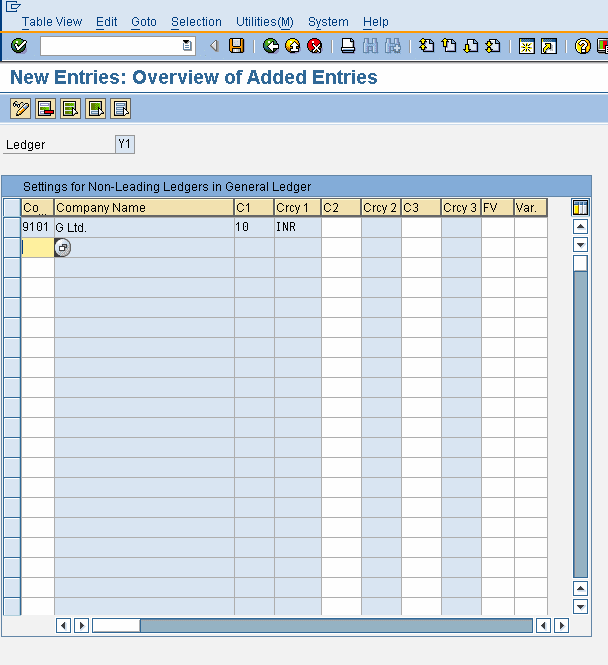

Ledger Y1 (additional ledger) for local reporting under the companies act.

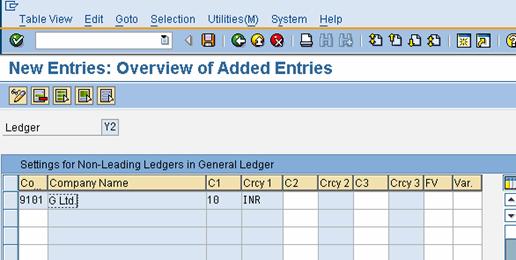

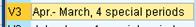

Ledger Y2 (additional ledger) for local tax reporting period (April to March)

Create company code 9101 – G Ltd. The company code currency– INR

Parallel currencies to be implemented – EURO

Common chart of accounts – YCCA

Ledger 0L (leading valuation view) reporting period – Jan to December for group reporting

Ledger Y1 (additional ledger) for local reporting under the companies act.

Ledger Y2 (additional ledger) for local tax reporting period (April to March)

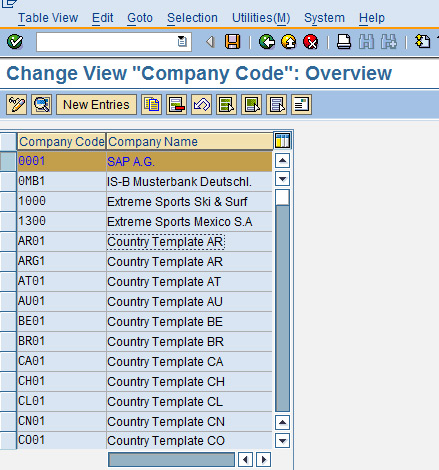

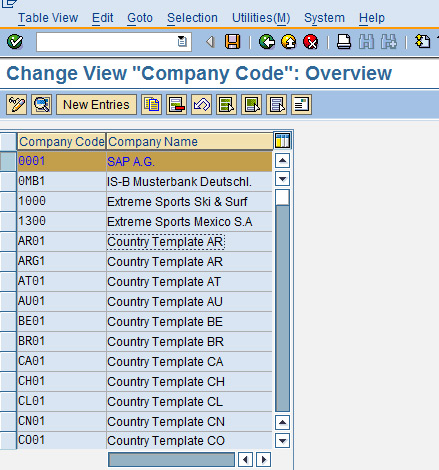

1. Creating Company Code

Company code is the basic organizational unit in FI (Financial accounting) for which a balance sheet and profit & loss account can be drawn. We create company code 9101 (G Ltd.) which is located in country India.

For doing the configuration we use the following path on the SAP application screen:-

For doing the configuration we use the following path on the SAP application screen:-

SAP Menu >> Tools >> Customizing >> IMG >> SPRO - Execute Project >>

Configuration for all the modules will be done here. The above path will not be referred henceforth; we will directly refer to the IMG node.

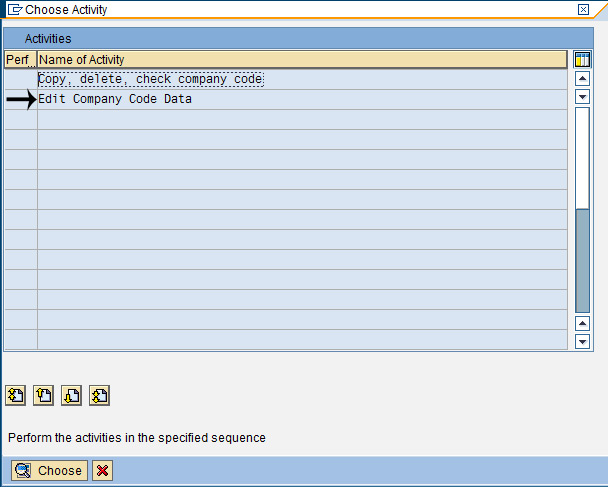

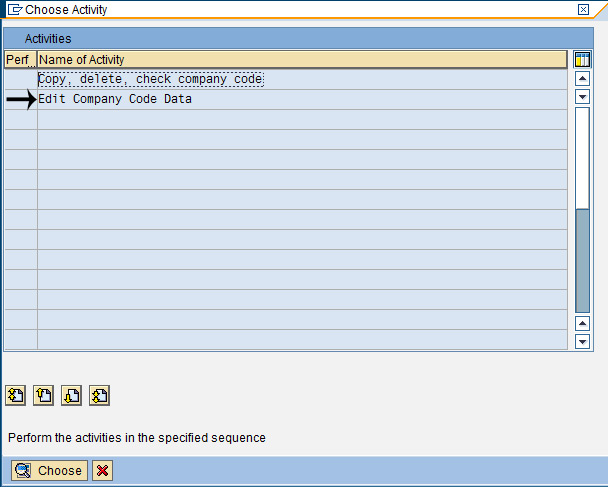

SAP Customizing Implementation Guide >> Enterprise Structure >> Definition

>> Financial Accounting >> Edit, Copy, Delete, Check Company Code

Configuration for all the modules will be done here. The above path will not be referred henceforth; we will directly refer to the IMG node.

SAP Customizing Implementation Guide >> Enterprise Structure >> Definition

>> Financial Accounting >> Edit, Copy, Delete, Check Company Code

Double click on Edit Company Code data

By selecting the second option Edit Company Code data you have to manually configure all the subsequent assignments.

By selecting the first option all the configuration and tables get copied automatically along with assignments. This option should be selected in case of rollouts.

By selecting the second option Edit Company Code data you have to manually configure all the subsequent assignments.

By selecting the first option all the configuration and tables get copied automatically along with assignments. This option should be selected in case of rollouts.

In the Copy option you need to click on COPY AS ICON to copy a company code from an existing company code. You can copy from existing com pany code delivered by SAP.

You can select a four-character alpha-numeric key as the company code key. This key identifies the company code and must be entered when posting business transactions or creating company code-specific master data, for example.

We will cover the FI configuration from scratch and not copying configuration from an existing company code.

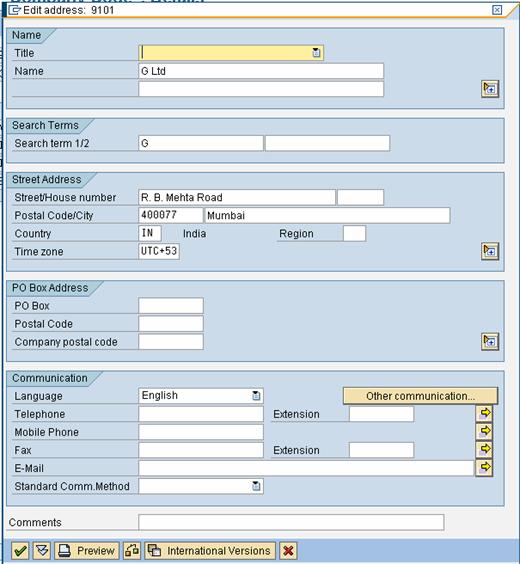

Click on and update the following fields:

and update the following fields:

The company code should be always kept numeric.

Country: The country where company code is located and the balance sheet and income statement which will be prepared according to that country law. Here the company is located in India so, we have selected the country id IN (INDIA).

You can select a four-character alpha-numeric key as the company code key. This key identifies the company code and must be entered when posting business transactions or creating company code-specific master data, for example.

We will cover the FI configuration from scratch and not copying configuration from an existing company code.

Click on

and update the following fields:

and update the following fields:

The company code should be always kept numeric.

Country: The country where company code is located and the balance sheet and income statement which will be prepared according to that country law. Here the company is located in India so, we have selected the country id IN (INDIA).

Currency: It is the local reporting currency of the country. In this case it is INR (Indian rupees) since the company is located in India.

Company code 9101 is created in SAP

2. Ledgers (New)

2.1.1 Ledger

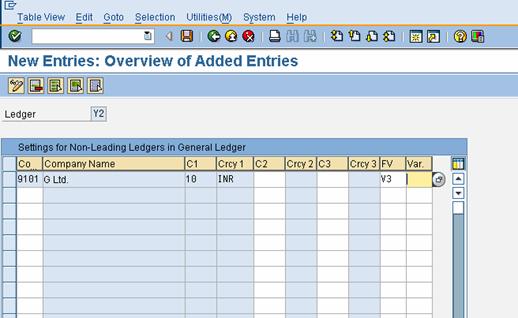

2.1.1.1 Define Ledgers for General Ledger Accounting

You define the ledgers that you use in General Ledger Accounting. The ledgers are based on a totals table. SAP recommends using the delivered standard totals table FAGLFLEXT.

The following types of ledgers are available:

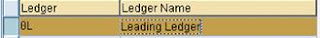

Leading Ledger

The leading ledger is based on the same accounting principle as that of the consolidated financial statement. It is integrated with all subsidiary ledgers and is updated in all company codes. You must designate one ledger as the leading ledger.

In each company code, the leading ledger automatically receives the settings that apply to that company code: the currencies, the fiscal year variant, and the variant of the posting periods.

In our scenario the group reporting is handled by the Leading Ledger.

Non-Leading Ledger

The non-leading ledgers are parallel ledgers to the leading ledger. They can be based for example on local accounting principles

You must activate a non-leading ledger by company code.

For each ledger th at you create, a ledger group of the same name is automatically created.

In each company code, the leading ledger automatically receives the settings that apply to that company code: the currencies, the fiscal year variant, and the variant of the posting periods.

In our scenario the group reporting is handled by the Leading Ledger.

Non-Leading Ledger

The non-leading ledgers are parallel ledgers to the leading ledger. They can be based for example on local accounting principles

You must activate a non-leading ledger by company code.

For each ledger th at you create, a ledger group of the same name is automatically created.

In our scenario the local reporting is handled by the Non- leading ledger.

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Define Ledgers for General Ledger Accounting

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Define Ledgers for General Ledger Accounting

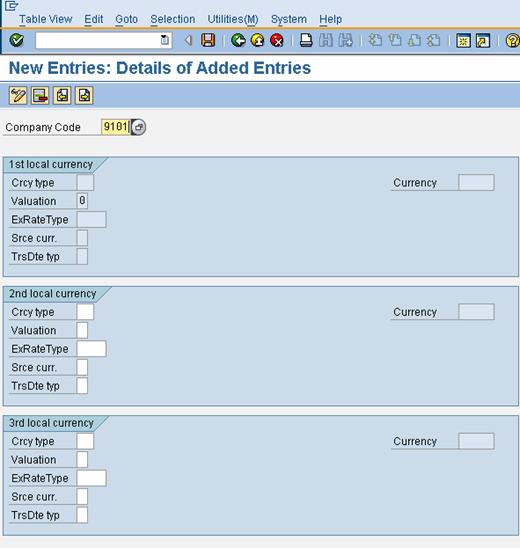

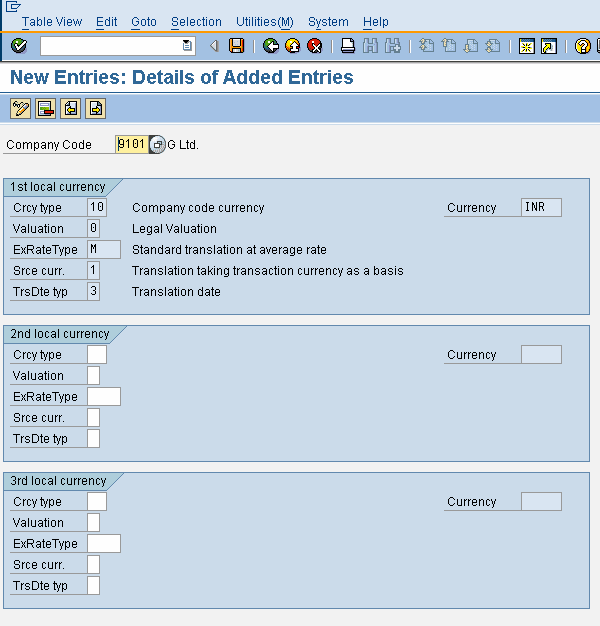

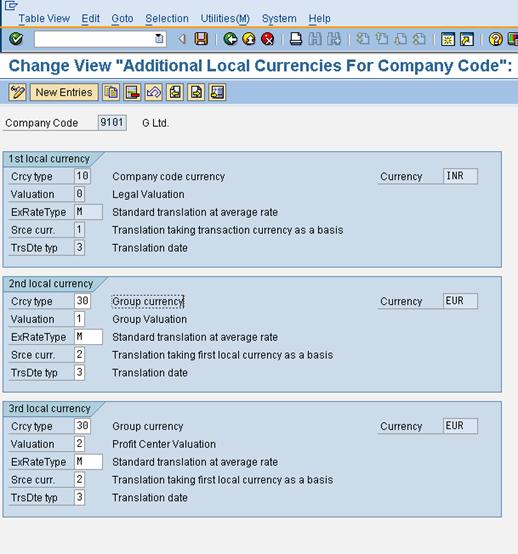

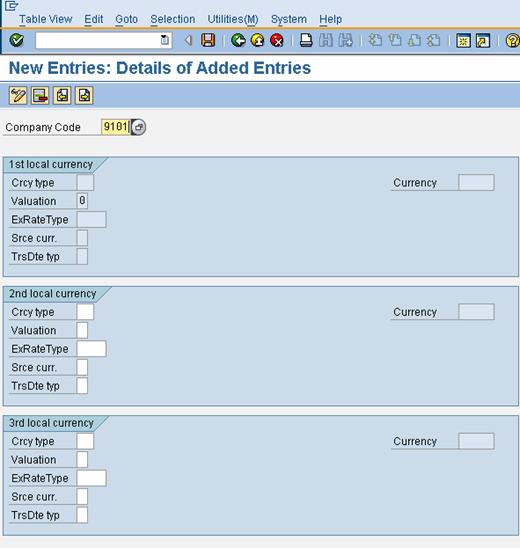

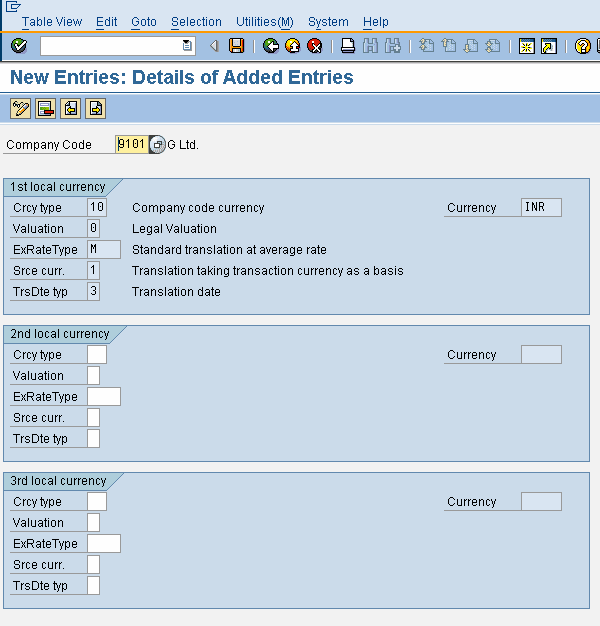

2.1.1.2 Define Currencies of Leading Ledger

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Define Currencies of Leading Ledger

Here you specify the currencies to be applied in the leading ledger. You can make the following settings for each company code

Click on

Update the following:-

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Define Currencies of Leading Ledger

Here you specify the currencies to be applied in the leading ledger. You can make the following settings for each company code

Click on

Update the following:-

Click

Now update the following:-

Click on

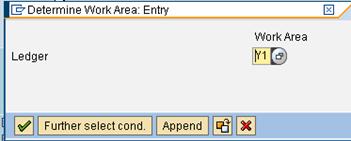

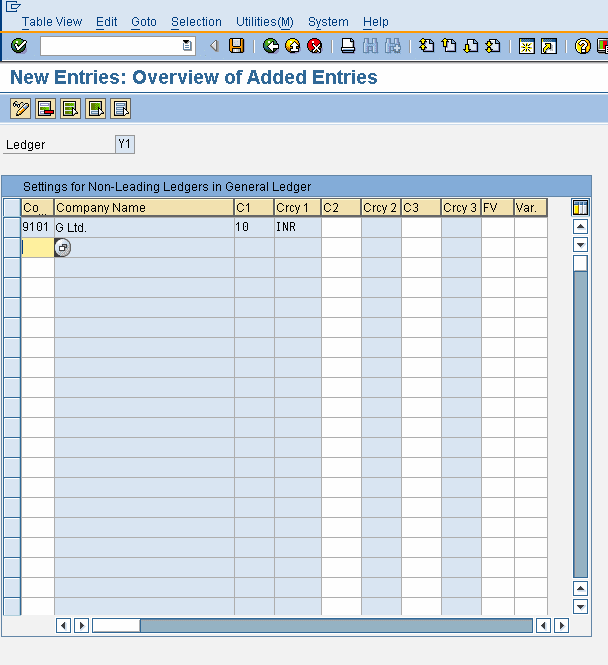

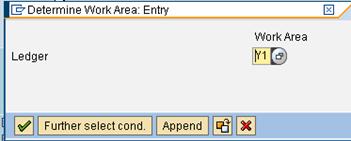

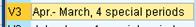

2.1.1.3 Define and Activate Non-Leading Ledgers

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Define and Activate Non-Leading Ledgers

Here you make the following settings for the non -leading ledgers for each company code:

You activate the non-leading ledgers in the company code.

You can define additional currencies beyond that of the leading ledger. The first currency of a non-leading ledger is always the currency of the leading ledger (and hence that of the company code). For the second and third currencies of a non-leading ledger, you can only use currency types that you have specified for the leading ledger.

You can define a fiscal year variant that differs from that of the leading ledger. If you do not enter a fiscal year variant, the fiscal year variant of the company code is used automatically.

You can specify a variant of the posting periods.

Update the following:-

Click on

Update the following:-

Update the following:-

Click on

Update the following:-

Update the following:

Take a drop down in the field FV (Fiscal year variant)

You can even assign a dif ferent posting period variant to this ledger

Click on

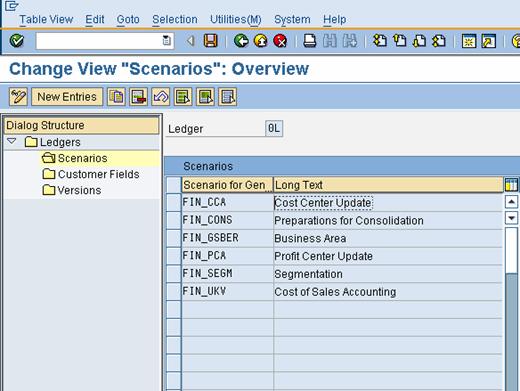

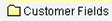

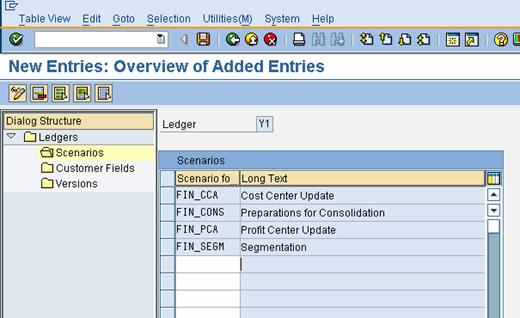

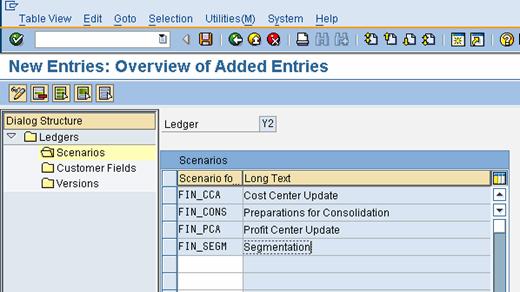

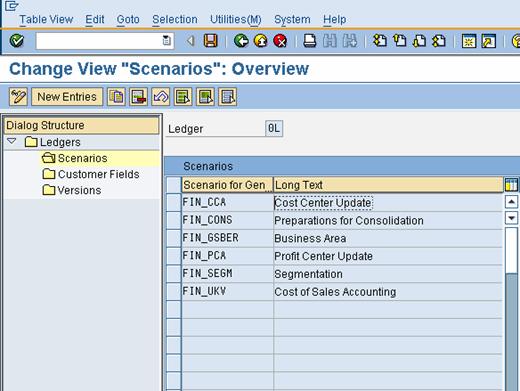

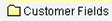

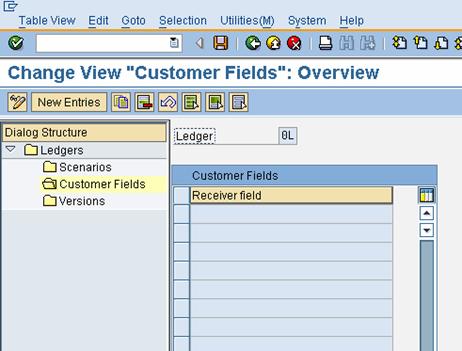

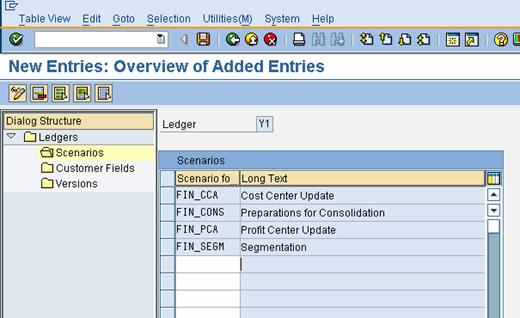

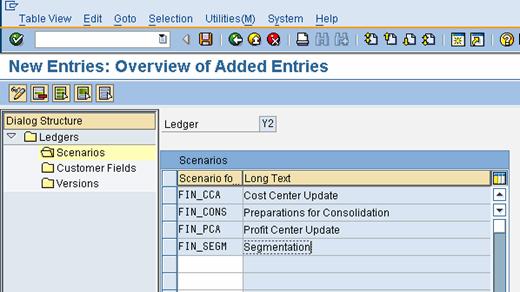

2.1.1.4 Assign Scenarios and Customer Fields to Ledgers

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Assign Scenarios and Customer Fields to Ledgers

In this IMG activity, you assign the following to your ledgers:

Scenarios

This determines what fields in a ledger are updated when it receives posting from other application components.

Custom Fields

You can add custom fields (that you have alread y defined) to the ledger.

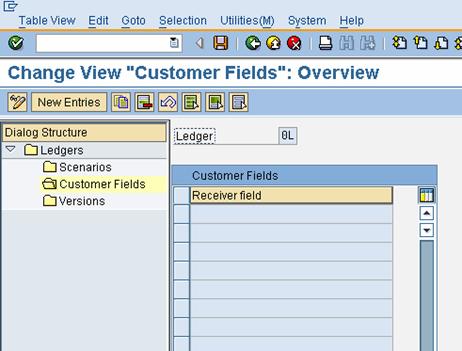

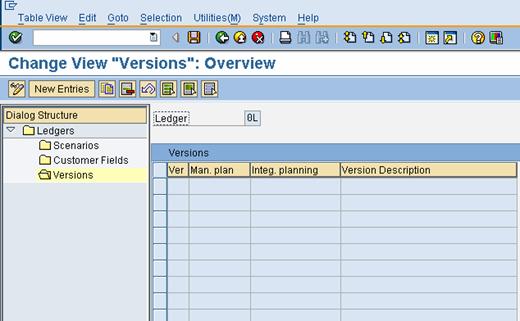

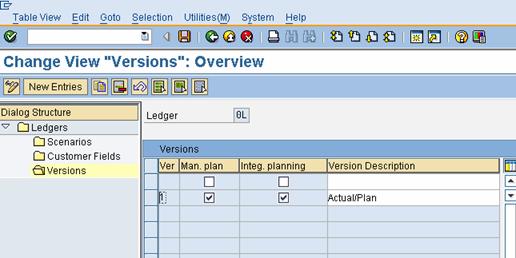

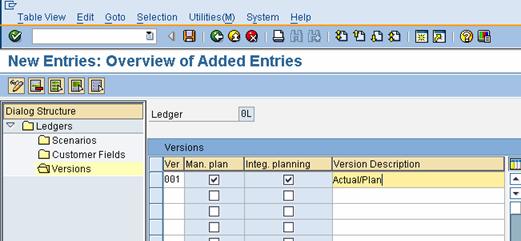

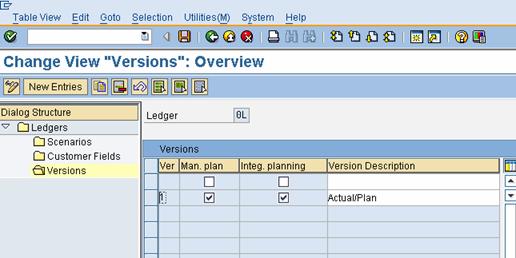

Versions

This enables you to make general version settings for the ledger that depend on the fiscal year. In the versions, you specify whether actual data is recorded, whether manual planning is allowed, and whether planning integration with Controlling is activated.

Select

Click

Click

Click

Click on

Click on

Click

Click

Select

Click

Click on

Update the following:-

Click on

To assign Profit center update you need to have profit center module active.

Click

Select

Click

Click on

Update the following:-

Click on

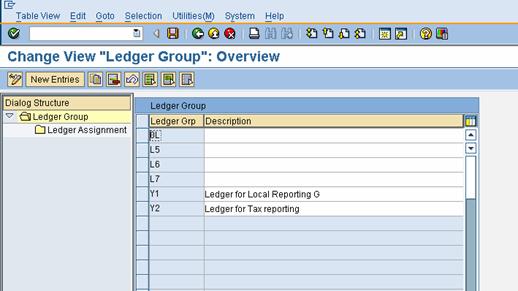

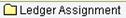

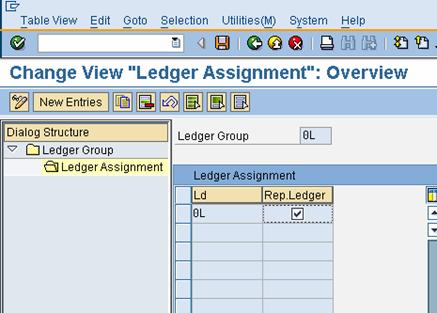

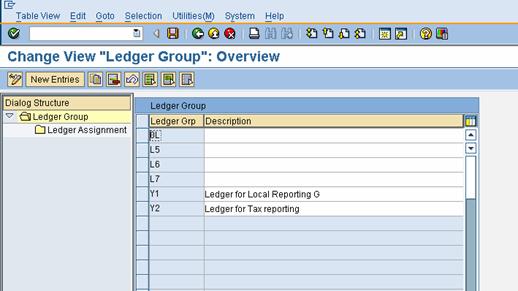

2.1.1.5 Define Ledger Group

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Define Ledger Group

Here you define ledger groups. A ledger group is a combination of ledgers for the purpose of applying the functions and processes of general ledger accounting to the group as a whole.

When posting, for example, you can restrict the update of individual postings to a ledger group so that the system only posts to the ledgers in that group. You can combine any number of ledgers in a ledger group. In this way, you simplify the tasks in the individual functions of General Ledger Accounting. When a ledger is created, the system automatically generates a ledger group with the same name. In this way, you can also post data to an individual ledger or access it when using functions where you can only enter a ledger group and not ledgers.

You can change t he name of the ledger group that was taken from the ledger.

You only have to create those ledger groups in which you want to combine several ledgers for joint processing in a function.

You do not need to create a ledger group for all ledgers because the system automatically posts to all ledgers when you do not enter a ledger group in a function.

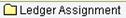

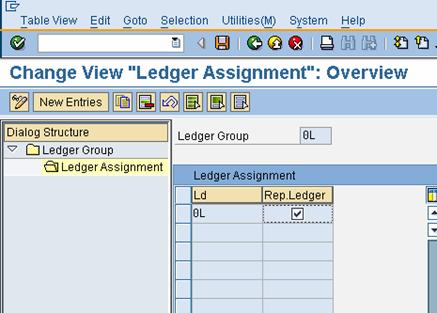

Representative Ledger of a Ledger Group

The system uses the representative ledger of a ledger group to determine the posting period and to check whether the posting period is open. If the posting period for the representative ledger is open, the system posts in all ledgers of the group, even if the posting period of the non-representative ledgers is closed. Each ledger group must have exactly one representative ledger:

If the ledger group has a leading ledger, the leading ledger must always be identified as the representative ledger.

If the ledger group does not have a leading ledger, you must designate one of the ledgers as the representative ledger. If the ledger group has only one ledger, this ledger is then the representative ledger. If the ledger group has more than one ledger, the system checks during posting whether the representative ledger was selected correctly. This check is based on the fiscal year variant of the company code:

We do not want to group the ledgers, therefore we do not do any configuration here.

Select

Double click

Select Y1

Double click

Similarly you can check Y2

2.1.1.6 Activate New General Ledger Accounting

IMG >> Financial Accounting >> Financial Accounting Global Settings >>

Activate New General Ledger Accounting (FAGL_ACTIVATION )

By activating New General Ledger Accounting, you achieve the following:

If you already use classic General Ledger Accounting in your production system, you need to perform the migration of this data before you activate

Note:

“SAP” is a trademark of SAP AG, Neurottstrasse 16, 69190 Walldorf, Germany. SAP AG is not the publisher of this material and is not responsible for it under any aspect.

Warning and Disclaimer

While every precaution has been taken in the preparation of this material, sapexperts.blogspot.com assumes no responsibility for errors or omissions. Neither is any liability assumed for damages resulting from the use of the information or instructions contained herein. It is further stated that the publisher is not responsible for any damage or loss to your data or your equipment that results directly or indirectly from your use of this material.

Courtesy: www.sapficoconsultant.com

Take a drop down in the field FV (Fiscal year variant)

You can even assign a dif ferent posting period variant to this ledger

Click on

2.1.1.4 Assign Scenarios and Customer Fields to Ledgers

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Assign Scenarios and Customer Fields to Ledgers

In this IMG activity, you assign the following to your ledgers:

Scenarios

This determines what fields in a ledger are updated when it receives posting from other application components.

Custom Fields

You can add custom fields (that you have alread y defined) to the ledger.

Versions

This enables you to make general version settings for the ledger that depend on the fiscal year. In the versions, you specify whether actual data is recorded, whether manual planning is allowed, and whether planning integration with Controlling is activated.

Select

Click

Click

Click

Click on

Click on

Click

Click

Select

Click

Click on

Update the following:-

Click on

To assign Profit center update you need to have profit center module active.

Click

Select

Click

Click on

Update the following:-

Click on

2.1.1.5 Define Ledger Group

IMG >> Financial Accounting (New) >> Financial Accounting Global Settings (New) >> Ledgers >> Ledger >> Define Ledger Group

Here you define ledger groups. A ledger group is a combination of ledgers for the purpose of applying the functions and processes of general ledger accounting to the group as a whole.

When posting, for example, you can restrict the update of individual postings to a ledger group so that the system only posts to the ledgers in that group. You can combine any number of ledgers in a ledger group. In this way, you simplify the tasks in the individual functions of General Ledger Accounting. When a ledger is created, the system automatically generates a ledger group with the same name. In this way, you can also post data to an individual ledger or access it when using functions where you can only enter a ledger group and not ledgers.

You can change t he name of the ledger group that was taken from the ledger.

You only have to create those ledger groups in which you want to combine several ledgers for joint processing in a function.

You do not need to create a ledger group for all ledgers because the system automatically posts to all ledgers when you do not enter a ledger group in a function.

Representative Ledger of a Ledger Group

The system uses the representative ledger of a ledger group to determine the posting period and to check whether the posting period is open. If the posting period for the representative ledger is open, the system posts in all ledgers of the group, even if the posting period of the non-representative ledgers is closed. Each ledger group must have exactly one representative ledger:

If the ledger group has a leading ledger, the leading ledger must always be identified as the representative ledger.

If the ledger group does not have a leading ledger, you must designate one of the ledgers as the representative ledger. If the ledger group has only one ledger, this ledger is then the representative ledger. If the ledger group has more than one ledger, the system checks during posting whether the representative ledger was selected correctly. This check is based on the fiscal year variant of the company code:

We do not want to group the ledgers, therefore we do not do any configuration here.

Select

Double click

Select Y1

Double click

Similarly you can check Y2

2.1.1.6 Activate New General Ledger Accounting

IMG >> Financial Accounting >> Financial Accounting Global Settings >>

Activate New General Ledger Accounting (FAGL_ACTIVATION )

By activating New General Ledger Accounting, you achieve the following:

- The functions for new General Ledger Accounting become available.

- In the SAP Reference IMG, the previous Financial Accounting menu is replaced by the Financial Accounting (New) menu. Under Financial Accounting Global Settings (New) and General Ledger (New), you can make the settings for New General Ledger Accounting.

- You activate the tables of new General Ledger Accounting so that your posting data is written to them.

If you already use classic General Ledger Accounting in your production system, you need to perform the migration of this data before you activate

Note:

“SAP” is a trademark of SAP AG, Neurottstrasse 16, 69190 Walldorf, Germany. SAP AG is not the publisher of this material and is not responsible for it under any aspect.

Warning and Disclaimer

While every precaution has been taken in the preparation of this material, sapexperts.blogspot.com assumes no responsibility for errors or omissions. Neither is any liability assumed for damages resulting from the use of the information or instructions contained herein. It is further stated that the publisher is not responsible for any damage or loss to your data or your equipment that results directly or indirectly from your use of this material.

Courtesy: www.sapficoconsultant.com

18 comments:

I have over 10 years of professional work experience in finance & accounts.

I am currently pursuing online training in SAP financials at siemens atos in chennai.

Since i am new to SAP environment i need to finetune my SAP skills back at home.

Can anybody suggest where to get a simulated SAP fico pack.

am ready to pay too.

Hi, This is shalini from Chennai learned SAP Training in Chennai from mr.karthick. The training really was good and i got selected in leading mnc company as SAP Consultant.

It is a really very excellent blog; I find all of your blogs were amazing and awesome. The way to get expert tips from everyone, not only I like that posts all peoples like that post.

Oracle Fusion HCM Technical Online Training

Aspiring to go ahead with SAP ABAP certification. Was looking for complete SAP ABAP questions and material to go ahead with C_TAW12_750 certification. I found your blog with very nice piece of information and go ahead to follow. I found other good websites too, that will too help me.!!! Later I am looking for online SAP ABAP Certification C_TAW12_750 practice questions and exam to boost my confident to crack ASQ certification exam at first attempt

Boost your ROI with the best SAP Uses List,

The SAP is one of the broadly used software used in almost all the industries. CarlsonsMedia can help you to reach out to maximum numbers of the target audience with the help of our SAP Users Mailing Lists. Our SAP Users Mailing Lists contains extensive and reliable SAP Customers List. The SAP Users Mailing List which we are providing promises to drive more audience engagements. We give you surety that the contact details provided by us will reach the industry standards

Hi, very nice post and informative article. Thanks for sharing great information.

BEST SAP INSTITUTE IN INDIA

SAP S/4 HANA Training Online

SAP HANA Online Training

SAP UI5 Online Training in India

Absolutely fabulous! Thanks for giving out excellent information About SAP FICO. Your post is fascinating and I have forwarded it to some of my links. I read lot of articles and really like this article. This information is definitely useful for everyone in daily life. Fantastic job. SAP FICO Course in Gurgaon

Thanks For sharing, Its highly informative post. I really enjoyed it. Thankyou

Eccountant offers industry-leading manufacturing ERP system to improve ROI across your business. Learn more about Eccountant ERP system cloud-based online solutions.

Thanks for providing this blog for us. Actually We are an Accounting solution company. Now a days maximum user working on the Accounting software and the availability of Quickbooks Support Phone Number can be easily solved. You have to dial 800-901-6679 for the urgent solution.

Visit on https://tinyurl.com/y5e6s475

Nice Blog We are providing technical support in Quickbooks Support Phone Number +1-800-986-4607. if you are Expand your business to a new hike, with progressive approach. Seeking for the best accounting software? Then, get QuickBooks installed in your system.

When I need a piece of advice, I will find your posts and read them. To me, they are very useful. I can make use of advice to resolve my problems. Sometimes, I read articles to learn new knowledge. I hope I will add more posts. Thank you so much.

SAP Partners in Mumbai

Really appreciate this wonderful post that you have provided for us.Great site and a great topic as well I really get amazed to read this. It's really good.

I like viewing web sites which comprehend the price of delivering the excellent useful resource free of charge. I truly adored reading your posting. Thank you!.

mobile phone repair in Fredericksburg

iphone repair in Fredericksburg

cell phone repair in Fredericksburg

phone repair in Fredericksburg

tablet repair in Fredericksburg

mobile phone repair in Fredericksburg

mobile phone repair Fredericksburg

iphone repair Fredericksburg

cell phone repair Fredericksburg

phone repair Fredericksburg

Great blog...

SAP Training in Chennai

Hey, Thanks for the informative blog which is a very helpful & important blog for SAP Technology. Nice blog

Keep Blogging!

SAP Online Training in India

Cool Post on SAP Domain.

SAP Training in Chennai

SAP ABAP Training in Chennai

SAP FICO Training in Chennai

SAP MM Training in Chennai

SAP SD Training in Chennai

Hi everyone

it is a good article blog. thanks for sharing.

SAP management consulting

Sap consulting services company

SAP C/4HANA

sap experts

ifrs 17 finance transformation

sap s4hana cloud

ifrs 9 financial instruments

sap consulting company India

Post a Comment